StockTickr Trading Journal

Good money management can mean all the difference in the world when it comes to your trading results.

I’m a big proponent of keeping tabs on trading results periodically so that you can know where to make adjustments in your game plan. It’s common knowledge to back down trading size during poor performance and ramp it up when trading well, but let’s go a step further.

Enter: Expectancy. Recently I did a post about position sizing, but it goes hand in hand with the topic of Expectancy. Simply stated, Expectancy is what you can expect to make (on average) per dollar risked. Mathematically it is calculated with the following equation:

Expectancy = (Winning Probability x Avg. Win) – (Losing Probability x Avg. Loss)

Although this formula isn’t difficult to calculate, there is a simpler way – let technology do it for you! StockTickr Pro offers a “Journal” which not only calculates your Expectancy, but also the factors which go into the equation above. If you’ve ever wondered what your win/loss rate is or what your average winning trade is, the Journal in StockTickr Pro will tell you. A trading tool like this will make it far easier and faster at the end of the week or month when you’re reviewing your trades to see what mistakes and weaknesses need working on so that you can correct them and avoid trading mistakes which are costing you.

The StockTickr Journal also includes some very cool and useful features such as dynamic position sizing and a great summary page where you can measure your progress over time in terms of your risk.

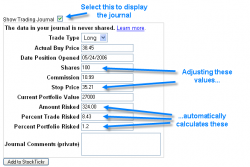

The dynamic position sizing allows you to enter variables like buy price, shares, portfolio value, percent portfolio risked, amount risked, and percent trade risked when determining stop prices. It changes on the fly, and you’ll have accurate calculations instantly when planning your trades. Once you enter your portfolio value, StockTickr will calculate a stop automatically when you access the journal for future trades. If you adjust the stop price or number of shares in the journal, your percent risked value is automatically adjusted. This lets you determine your position size quickly and easily so you don’t risk too large a percentage of your total portfolio.

The StockTickr Journal allows you to enter comments on your trade and calculate your position size and stop loss levels on the fly – a great tool for traders of any timeframe! (Click for larger image.)

The StockTickr Journal allows you to enter comments on your trade and calculate your position size and stop loss levels on the fly – a great tool for traders of any timeframe! (Click for larger image.) The journal summary page lets you view the overall expectancy of your trading and gives you a graph of your trades in terms of R, or risk. You can also view overall expectancies by tag, trade type (long or short), or by time frame. For example, let’s say you trade some pull backs and some breakouts. You could tag those trades with “pull back” and “breakout” and then compare the expectancies of each of those strategies. The founder of StockTickr has made his journal summary public for all to see here: http://www.stocktickr.com/report/totalr/davemabe/.

The Journal Comments is a great place to type out some thoughts on the trade to take a look at later. This is the perfect remedy for those trades you nail but you can’t remember what it was that you were thinking before you put it on! Sitting at the keyboard all day typing in random stock symbols has its benefits – we traders can type very quickly! This makes punching in your thoughts on trades an absolute breeze and your notes will be there down the road when you want to review them. Although StockTickr is a “social investing” site where ideas are exchanged through Watch Lists and Tags, the Journal does allow you to keep your trades private (this setting can be changed if you want to make your Journal public). This way you can share ideas and Watch Lists without letting the world see your results if you so desire.

All said, StockTickr’s Trading Journal has some great features, especially for the incredibly low price of the Pro version. If you haven’t checked it out, I highly recommend it. Consider it the go-to site for your position sizing and expectancy needs (and a lot more!).

You can sign up for StockTickr Pro here.

Jeff White

President, The Stock Bandit, Inc.

www.TheStockBandit.com

Lori Belge | May 30, 2006 | Reply

Dear Jeff: I am humbly returning to your site after a two week trialin the past, and a forced health hiatus. I have reviewed many sites in the meantime while convalescing and still maintain, your recommendations are by far the most helpful. Returning to your site was great: I was greeted by an even more professional website and numerous upgrades. thanks. Lori B.