Archive for May, 2011

Archive for May, 2011

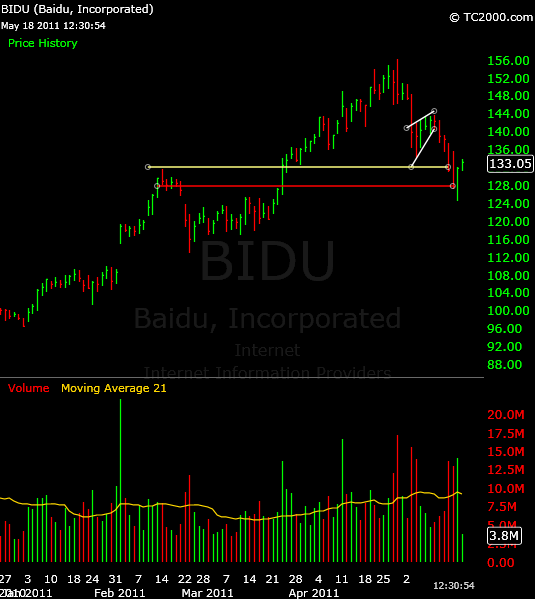

Trade Review: BIDU Breakdown

May 18, 2011 at 11:56 am

One setup I recently had success with was found in BIDU. Although the money’s been made on this trade, there are still some lessons we can take away, so let’s take a closer look at the trade as it evolved and see what we can learn from it.

The entire Chinese internet stock group had been weakening of late, with names like SOHU, SINA, NTES, and others beginning to struggle. This followed months of leadership, as these stocks made big upside runs by building bases upon bases. The momentum shifted a few weeks ago, and in every case these stocks topped prior to the market’s pullback. (That’s why they call them leaders).

BIDU did the same thing, having peaked in late-April ahead of the major averages like the NASDAQ. Once the overall market began to pull in, these stocks accelerated to the downside, providing further evidence of an important change of character. Having become oversold, they rebounded, but in a lazy fashion. This set up quite a few bearish patterns, with the rising wedge being found in BIDU. I highlighted this pattern for premium readers on the main site, looking to short BIDU upon a break of the lower trend line at $139.50.

BIDU broke that rising trend line, a day after its counterparts NTES & SINA. That offered not only a clean entry for a short sale, but also a stock which had potential to play catch-up on the downside.

I set a pair of targets for booking profits at $132 (yellow line in chart below) and $127.50 (red line on chart below), respectively. Target 1 was reached on day 3 of the breakdown, which was just slightly ahead of the 2/14 high in case it were to be tested. Target 2 was reached on day 4, and that level corresponded with the lower end of the same mid-February congestion zone.

While this stock eventually overshot my $12 per share profit target, it became oversold. Anytime a stock moves too far, too fast, it’s time to watch for a snapback. BIDU has done that in the past 2 sessions, but remains technically damaged. Here’s a current look:

This stock and the others in the group are currently bouncing from their lows, but they remain in a bearish series of lower relative highs on their daily charts. That is to say this bounce may get sold into again, so although this short sale is long since over, we have no evidence yet to support a lasting trend change. Until we do, these are stocks to watch for new short-sided entries to emerge.

A few takeaways:

First, clean patterns are the place to focus. They make it simpler for me to recognize when to be IN a trade, and perhaps most importantly, when to be OUT of the trade. Tighter, more well-defined patterns help me be decisive, and in this game, that’s huge.

Second, stay on top of the sectors. While it’s a bit harder these days to play follow-the-leader when it comes to sector moves, it can still be done with success. Take note of which groups are shaping up for advances or declines, and work the charts for favorable candidates.

Third, when you get your move, ring the register. Greed could have kept me in this trade for a little bigger move, but it also could have kept me in too long, leaving me now to wonder what to do on the current bounce. Blend the info you get by looking left on the chart along with the pattern projection to come up with an exit strategy. Then stick to it!

Fourth, (and this goes hand-in-hand with the previous note), sharper moves are more prone to reversal. When your targets are in sight (or already hit) and the move is getting a bit stretched, expect the rubber band to snap back at least part way. Tighten your stops, book gains, and generally start expecting an imminent exit. Pigs truly do get slaughtered.

Here’s to your next trade, whether a winner or loser, and your commitment to take from it what you can – whether it be profits, a lesson, or both.

Trade Like a Bandit!

Jeff White

Producer of The Bandit Broadcast

Are you following me on Twitter yet?

Dealing with the Pop and Drop Trade

May 17, 2011 at 1:43 pm

This question came in from a fellow Bandit recently, and I wanted to share it (and my response back to him) with you here…

Question:

Jeff, what’s the lesson to be learned from this today. One trade I was watching (***) moved past 13.45 in a hurry this morning. By the time a trade could be executed it was already up in the 13.60s, got up as high as 13.74 and then dropped like a rock back down to where it started the day. All of it happened in about an hour. I’m thinking it would have been better to leave this one alone today. Thoughts? B

Answer:

That one did shoot quickly past the trend line, and anytime that’s the case I try to lighten up into the move. The sharper the moves tend to be, the more prone to reversal they are. So while it’s nice to see a big fast favorable move, at the same time it’s imperative to recognize that it may not last long and to use that strength to book some profits.

Another thing I’d add is that anytime you happen to get a bad fill on your order (in this case 13.60 as you mentioned when you wanted 13.45, it’s important to recognize that the risk/reward profile of the trade has just changed. You might have intended to exit around 13.30, or just about 1% from your entry, but a higher-than-intended entry necessitates raising your stop aggressively in order to offset the late buy. Otherwise, your stop is simply too far down and the risk/reward is no longer as favorable as your original plan for the trade.

Another thing I’d add is that anytime you happen to get a bad fill on your order (in this case 13.60 as you mentioned when you wanted 13.45, it’s important to recognize that the risk/reward profile of the trade has just changed. You might have intended to exit around 13.30, or just about 1% from your entry, but a higher-than-intended entry necessitates raising your stop aggressively in order to offset the late buy. Otherwise, your stop is simply too far down and the risk/reward is no longer as favorable as your original plan for the trade.

The idea is to keep managing risk, keep managing risk, keep managing risk when day trading. Sometimes you get ‘slipped’ on an order like that and end up with a later-than-intended entry, so when you do, either keep a tight stop beneath it or trail it behind the trade aggressively so as to either exit with a minimal loss or book a little gain. If the trade doesn’t unfold as planned, look for the next-best alternative, which is getting out about flat or slightly better if possible.

Sometimes as you said, hindsight will show stocks which may have been better left alone, but on the fly we can still manage the situation well with some good habits.

Trade Like a Bandit!

Jeff White

Producer of The Bandit Broadcast

Are you following me on Twitter yet?